Porinju Veliyath 8th March 2022

Several investors have worries around current global geopolitical situation created on account of Russia & Ukraine war.

We are not geopolitical experts and will resist giving any views on the War as such; but we do believe we have some reasonable framework to think as an investor around such events.

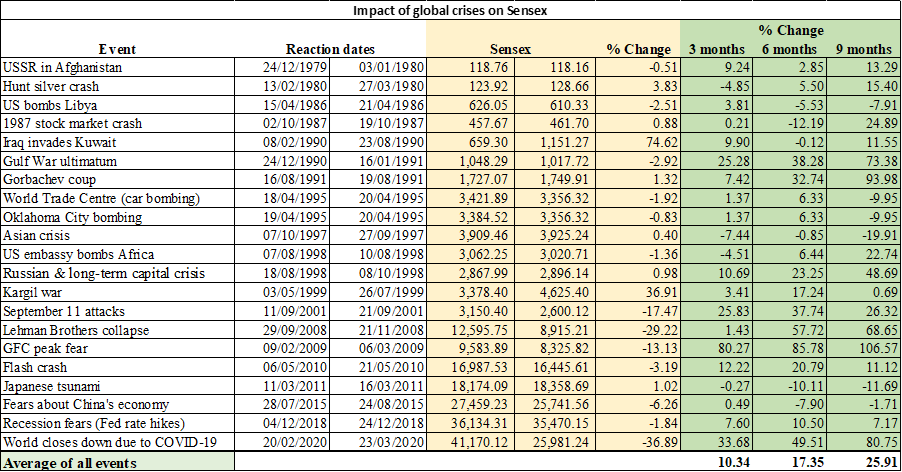

Typical reactions of Indian equity market around Geopolitical crises are captured well by below data curated by EQ research team.

Data points to average 6-month gains above 17% and average 9-month gains of around 26% post the initial fall on Sensex (Average means little in terms of prediction but points to a pattern). As it can be observed, worst gets over in first few weeks and in medium to long term almost always they end up becoming great buying opportunities - albeit in hindsight!

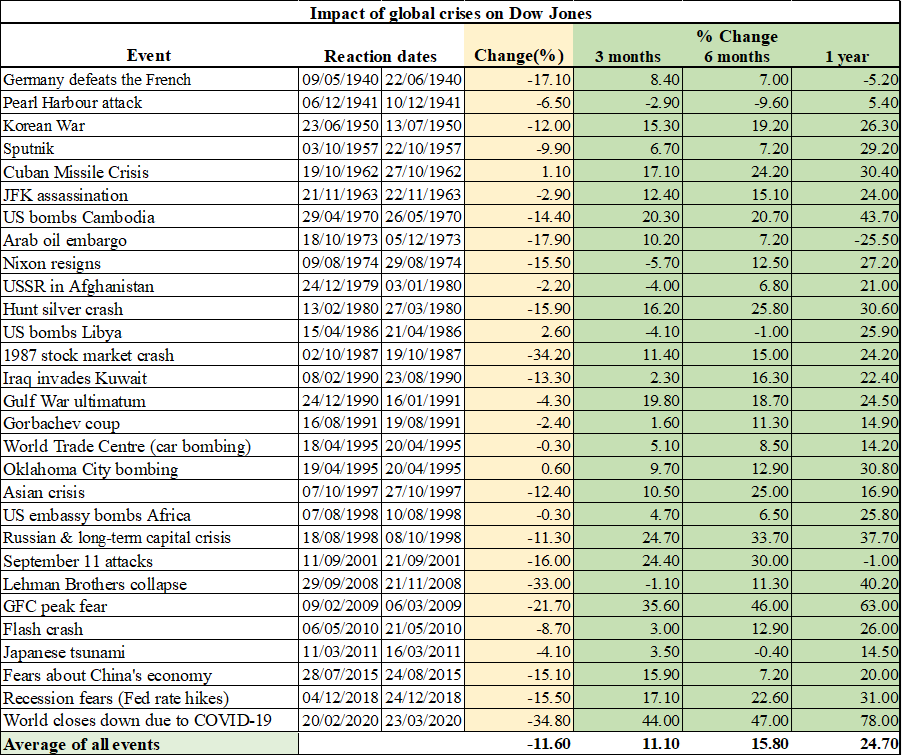

Dow Jones has much longer history and the patterns are similar. Average performance of Dow Jones post crises’ reaction period clearly shows strong positive returns. In every instance, stocks dipped sharply on the fear of war and rebounded sharply as the war scare subsided.

Historical patterns are extremely important tool in investors’ arsenal. Many investors get swayed by headlines and their implications on macros. However, it is prudent and humbling to note that “No One Knows about Anything” during such turbulent phase. “Turbulence is scary but temporary” is the only rational thought to have as an investor.

Here is what legendary investor Philip Fisher wrote in his classic book Common Stocks and Uncommon Profits. It is a long passage, but we think it is very instructive for all value investors…

“…. Common stocks are usually of greatest interest to people with imagination. Our imagination is staggered by the utter horror of modern war. The result is that every time the international stresses of our world produce either a war scare or an actual war, common stocks reflect it. This is a psychological phenomenon which makes little sense financially………. Any decent human being becomes appalled at the slaughter and suffering caused by the mass killings of war. In today’s atomic age, there is added a deep personal fear for the safety of those closest to us and for ourselves. This worry, fear, and distaste for what lies ahead can often distort any appraisal of purely economic factors. The fears of mass destruction of property, almost confiscatory higher taxes, and government interference with business dominate what thinking we try to do on financial matters. People operating in such a mental climate are inclined to overlook some even more fundamental economic influences…. Nevertheless, at the conclusion of all actual fighting – regardless of whether it was World War I, World War II, or Korea – most stocks were selling at levels vastly higher than prevailed before there was any thought of war at all. Furthermore, at least ten times in the last twenty-two years, news has come of other international crises which gave threat of major war. In every instance, stocks dipped sharply on the fear of war and rebounded sharply as the war scare subsided…...”

Physicist Richard Feynman once said “I can live with doubt, and uncertainty, and not knowing. I think it’s much more interesting to live not knowing than to have answers which might be wrong.” …and we think to panic around such global crises has proven to be wrong most of the times for investors.

Equity Intelligence has always been inspired by two classic traditions – first of Value Investing & second that of Kerala’s own ancient martial art Kalarippayattu. Bruce Lee, though not an exponent of Kalarippayattu but one of the legendary martial artists has said, “We do not analyse, we Integrate”. Several situations in markets are complex and doesn't lend itself well to traditional analyses; but the classical principles allow us to integrate with sound pattern recognition.

To conclude:

• It is natural psychological reaction to fear and worry around such events.

• Historical evidence that stocks invariably bounce back sharply post first fear reactions around war is recurring pattern.

• Sound Investment action around events like these being played out between Russia & Ukraine would be to buy on dips and not to panic sell when crises are on.

We are very comfortable with portfolio of businesses we own. We see current decline in “Prices” as temporary and “Value” in underlying companies more enduring with passage of time.

Regards

Porinju Veliyath